Mastering the Basics: How to Backtest a Trading Strategy Effectively

Backtesting a trading strategy involves using historical data to evaluate its potential performance before risking real money. This process helps traders gauge profitability, assess risk, and fine-tune their strategies. In this article, we’ll cover the essential steps for effective backtesting, including defining your strategy, gathering data, executing the strategy on past data, and analyzing results. Additionally, we will discuss how to backtest a trading strategy effectively. By the end, you’ll have a solid foundation to start backtesting your own trading strategies confidently.

Table of Contents

Key Takeaways

- Backtesting is essential for evaluating trading strategies, helping traders simulate trades and analyze performance using historical data.

- A structured backtesting process includes defining the trading strategy, gathering quality historical data, executing the strategy on past data, and analyzing performance metrics.

- Common pitfalls in backtesting, such as overfitting and ignoring trading costs, can lead to misleading results; awareness and strategy validation are key to effective backtesting.

Understanding Backtesting in Trading

Backtesting is a crucial tool in the arsenal of any serious trader. It involves testing a trading strategy using historical data to evaluate its potential performance in the financial markets. Applying a strategy’s rules to past market data allows traders to simulate trades and analyze potential performance in real-world conditions. This process is invaluable for understanding profitability, assessing risk, and comparing different backtest trading strategies.

The primary purpose of backtesting is to provide traders with a reliable way to evaluate their trading strategies before risking real capital. Successful backtesting can give traders the confidence to implement their strategies in live trading, knowing that they have been rigorously tested. It also helps identify any weaknesses or areas for improvement, allowing traders to refine their strategies over time.

Backtesting is not a one-time task but an iterative process that involves continuous refinement and optimization of trading strategies. Using data from various market conditions helps traders ensure that their backtesting results are robust and reliable. This iterative approach helps to build a solid foundation for successful trading, mitigating risks and enhancing the chances of achieving profitable trades.

Essential Steps to Backtest a Trading Strategy

Effective backtesting of a trading strategy requires a structured approach. This involves several key steps, each of which plays a crucial role in ensuring the accuracy and reliability of the backtesting process.

The steps include defining the trading strategy, gathering historical market data, executing the trading strategy performed on past data, and recording and analyzing the results. Let’s delve into each step in detail.

Define Your Trading Strategy

The first step in backtesting is to define your trading strategy clearly. This requires outlining entry and exit points. It also involves determining position sizing and establishing risk management rules. For instance, a common entry rule might be to buy when the 50-day moving average crosses above the 200-day moving average, and sell when it crosses below. Articulating these rules precisely ensures effective backtesting.

In addition to entry and exit criteria, it is important to define position sizing and risk management parameters. This ensures that traders know how to manage their capital effectively and adhere to their trading rules.

Before manual backtesting, it is recommended to define the strategy conceptually and examine around 20 instances on charts to get a feel for its performance.

Gather Historical Market Data

Once the trading strategy is defined, the next step is to gather historical market data. Quality historical data is crucial for accurate backtesting, as poor data can lead to misleading analysis results. Traders need historical price data, including open, high, low, close prices, and volume, to backtest their strategies effectively.

Historical data can be obtained from various sources, including financial websites like Yahoo! Finance, data vendors, or brokers. Accurate and reliable data are crucial for obtaining valid backtesting results.

Comprehensive and high-quality historical market data allows traders to better simulate trades and assess strategy performance under different market conditions.

Execute the Strategy on Past Data

With the historical data in hand, the next step is to apply the defined trading strategy to this data. This involves simulating trades based on the strategy’s entry and exit rules. This process gives traders a clear picture of past performance, providing valuable insights into the strategy’s effectiveness.

Simulating trades on historical data allows traders to understand the strategy’s performance over different market conditions. It helps in identifying any potential issues or areas for improvement, ensuring that the strategy is robust and reliable before moving on to live trading. This step is crucial for validating the strategy and gaining confidence in its potential success.

Record and Analyze Results

After executing the investment strategy on past data, it is essential to record and analyze the results. Tracking key performance metrics, such as cumulative returns, annualized returns, and the equity curve, provides insights into the strategy’s overall success.

Analyzing these metrics helps traders objectively assess the strengths and weaknesses of their strategy, allowing for necessary adjustments to enhance performance.

Manual vs Automated Backtesting

When it comes to backtesting, traders have two primary options: manual backtesting and automated backtesting. Each method has its own set of advantages and challenges. Manual backtesting involves manually applying the trading strategy to historical data, which can be time-consuming and prone to human error. However, it can also help traders build a deeper understanding of market dynamics and develop their trading skills.

On the other hand, automated backtesting uses software to perform the analysis, allowing for faster and more consistent results. Automated algorithms can test strategies across multiple securities and timeframes simultaneously, significantly outperforming manual methods in terms of speed and efficiency. However, automated backtesting also requires some programming knowledge and can sometimes introduce new opportunities for human error.

Manual Backtesting Techniques

Manual backtesting follows the same principles across various financial markets. It involves meticulously recording entries, resulting profits, and losses throughout the trading window to ensure accurate analysis. Traders often prefer manual backtesting as it aids in building their market knowledge and recognizing visual cues, patterns, and variations in market behavior.

For effective manual backtesting, it is recommended to use one-minute or five-minute chart timeframes for intraday strategies and consider the time of day to ensure the reliability of the information being used. This approach helps traders assess profit from historical trades by calculating cumulative profits and losses based on their entries and exits.

Tools for Automated Backtesting

Automated backtesting tools can significantly streamline the backtesting process. Common backtesting software includes platforms like MetaTrader, TradingView, and others that provide robust tools for backtesting and live trading. These platforms often require some coding knowledge, with languages like Python, C, and R being popular choices for implementing trading strategies.

Python, in particular, is mentioned as an easy-to-learn programming language for trading, making it accessible for many traders. These automated tools allow traders to perform analysis, calculate winning and losing trades, and quickly optimize and conduct multiple backtests, enhancing the efficiency and accuracy of the backtesting process.

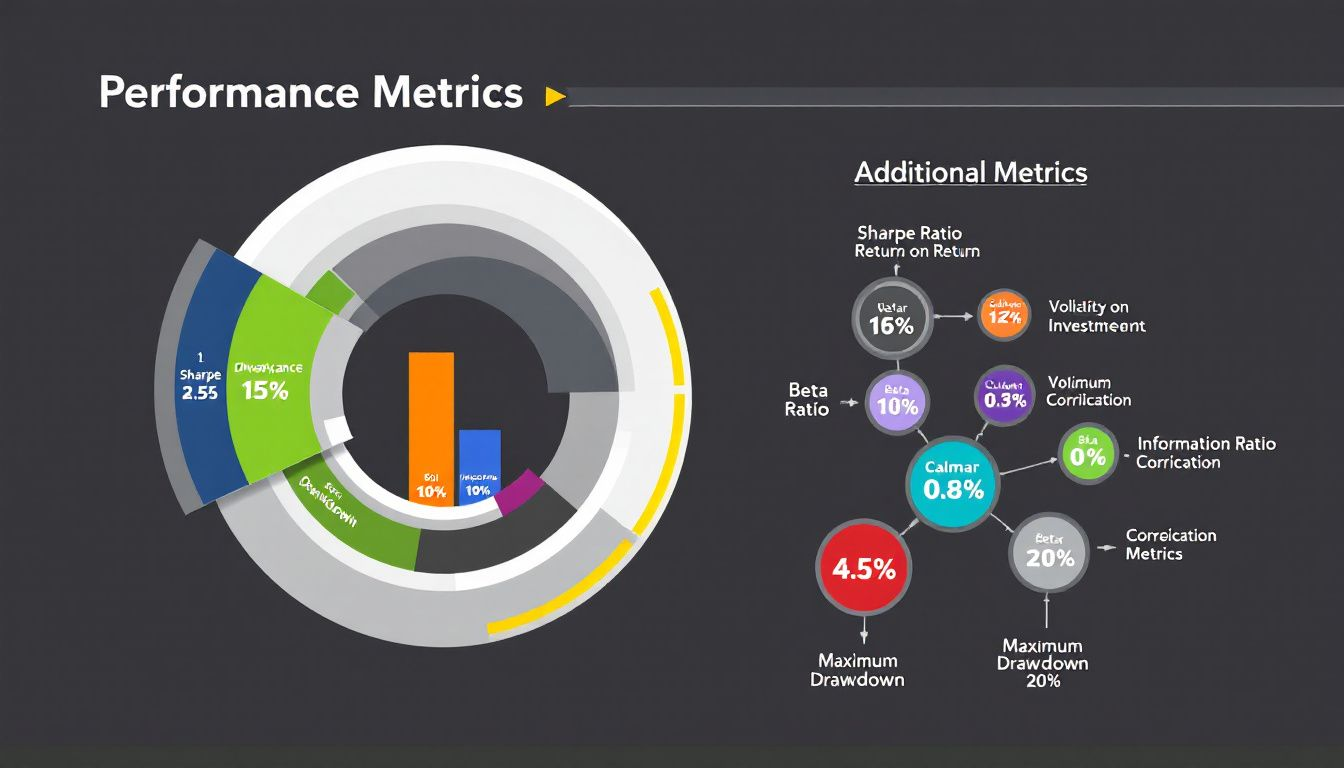

Key Metrics for Evaluating Backtesting Performance

Evaluating the performance of backtested trading strategies involves analyzing several key metrics. These metrics provide insights into the profitability, risk, and overall effectiveness of the strategy. Key performance metrics consist of several factors. These include profit and loss (P&L), risk-adjusted returns (Sharpe ratio), and win rate.

Assessing these metrics enables traders to make informed decisions about the viability of their trading strategies.

Profitability Metrics

Profitability metrics are essential for measuring the success of a trading strategy. Cumulative returns represent the total gain or loss over a specific period, expressed as a percentage. For example, if an investment of $10,000 grows to $18,000, the cumulative return is 80%. Annualized returns represent the average compounded rate of return earned each year, providing a clearer picture of the strategy’s long-term performance.

Another critical measure is the Compound Annual Growth Rate (CAGR), which reflects the annual growth rate of an investment over a specified time period. The average return across all trades is also a key profitability metric, helping traders to understand the overall effectiveness of their strategy.

Risk Metrics

Risk metrics are crucial for evaluating the potential risks associated with a trading strategy. Standard measures of risk include volatility and maximum drawdown, which indicate the potential losses of a strategy. The Sharpe ratio measures excess return per unit of risk, calculated as the portfolio returns minus risk-free returns, divided by the portfolio returns standard deviation.

The Sortino ratio assesses returns per unit of downside risk by replacing total standard deviation with downside deviation. These metrics help traders understand the risk-adjusted returns of their strategies and make informed decisions about their trading approaches.

Trade Statistics

Trade statistics provide detailed insights into the performance of individual trades. Key metrics include entry and exit points, trade duration, and profit or loss. The average trade duration indicates how long trades are typically held, influencing overall strategy performance.

The win/loss ratio, which indicates the number of winning trades relative to losing trades, is a critical metric for evaluating a strategy’s effectiveness. Analyzing these statistics ensures that strategies meet objectives and allows for refinement as needed.

Common Pitfalls and Biases in Backtesting

Backtesting is a powerful tool, but it’s not without its pitfalls. Common mistakes and biases can lead to inaccurate results and misguided trading decisions. One such issue is survivorship bias, which occurs when data from assets that no longer exist is omitted, leading to overly optimistic performance results. Failing to account for all trading costs can also significantly affect profitability assessments.

Complex strategies are harder to backtest accurately, potentially leading to flawed performance evaluations. Traders must be aware of these biases and take steps to mitigate them to ensure the accuracy and reliability of their backtesting results.

Overfitting

Overfitting occurs when a trading strategy is excessively tailored to fit historical data, leading to unrealistic performance results. This can give a false indication of strategy success, as the strategy might not perform well in real market conditions.

Avoiding overfitting involves validating the strategy on a separate testing set, dividing the dataset appropriately, and steering clear of excessive optimization. Avoiding data dredging is also crucial to prevent falsely indicating success for strategies that wouldn’t perform well in real markets.

Look-Ahead Bias

Look-ahead bias occurs when future data is inadvertently used in backtesting, compromising the validity of the results. Using future data does not reflect the actual conditions at the time of trading and can lead to unrealistic performance results.

Avoiding look-ahead bias requires traders to use only in-sample data available at the time of the trading decisions.

Ignoring Trading Costs

Ignoring trading costs can significantly distort the perceived profitability of a trading strategy. Accounting for various trading costs, such as commissions and slippage, is crucial for obtaining realistic performance metrics during backtesting.

Including these costs ensures an accurate assessment of a strategy’s effectiveness and helps traders make informed decisions.

Practical Tips for Effective Backtesting

Implementing best practices can enhance the effectiveness of your backtesting process. Practical strategies can significantly improve the reliability of backtesting results. Excessive optimization can mask a strategy’s true performance across different market conditions, so it’s essential to avoid over-optimizing.

Use Sufficient Historical Data

Sufficient historical data is necessary for effective backtesting period to ensure results indicate potential performance. It is recommended to backtest over a significant period, preferably capturing several market cycles, to understand how the strategy performs across different conditions.

Selecting a relevant historical period accurately reflects market conditions and helps recognize diverse market behaviors.

Validate with Out-of-Sample Testing

Out-of-sample testing is a critical method to verify a strategy’s effectiveness on unseen data. It helps confirm that a trading strategy remains effective outside the initial data set. Testing with out-of-sample data provides additional evidence of a strategy’s reliability and helps prevent overfitting.

Incorporate Scenario Analysis

Scenario analysis evaluates potential outcomes of different hypothetical scenarios. It assesses future possibilities in various market conditions and considers market-specific events that can significantly impact results.

It is important to consider one-off global or political events. Such occurrences can have an impact on market dynamics, especially for longer-term strategies.

Transitioning from Backtesting to Live Trading

Transitioning from backtesting to live trading is a significant step that requires careful preparation. Treating paper trading as if it’s live trading helps build essential trading skills and confidence.

Maintaining a trading journal during paper trading can help refine strategies by analyzing trade outcomes.

Paper Trading

Paper trading is a risk-free way to practice trades before transitioning to live trading. Using a demo account with virtual funds allows traders to practice without risking real capital. Platforms like TradingView offer free demo accounts that can be used to backtest strategies.

Treating paper trading seriously allows traders to develop their strategies and build confidence.

Risk Management in Live Trading

Proper risk management is crucial when transitioning to live trading. Past performance doesn’t guarantee future results, so traders should remain cautious and test their strategies thoroughly before putting real money into trading.

Reassessing trades and performance helps make informed decisions during live trading, and if setbacks occur, traders may return to paper trading for strategy refinement.

How to Backtest Using Popular Platforms

Backtesting on popular platforms like MT4 and TradingView can provide traders with powerful tools to refine their strategies. These platforms offer robust backtesting capabilities and are widely used in the trading community.

Backtesting on MT4

MetaTrader 4 (MT4) provides the Strategy Tester tool for backtesting trading strategies using historical data. To utilize the Strategy Tester in MT4, traders need to create automated trading programs via Expert Advisors. This tool allows for detailed analysis and optimization of trading strategies, helping traders refine their approaches before moving to live trading.

Backtesting on TradingView

TradingView offers an intuitive interface and powerful backtesting tools, making it a popular platform for traders. The platform’s rewind tool allows traders to analyze past trades without knowing future market movements, providing an accurate simulation of historical trading conditions.

TradingView’s free tier is attractive for traders as it allows access to basic functionality without any cost.

Summary

Backtesting is an essential practice for traders aiming to refine their strategies and improve their chances of success in live trading. By understanding the key steps involved, utilizing both manual and automated backtesting techniques, and being aware of common pitfalls, traders can enhance the effectiveness of their backtesting efforts.

Incorporating practical tips, such as using sufficient historical data, validating strategies with out-of-sample testing, and conducting scenario analysis, further ensures the reliability of backtesting results. Transitioning from backtesting to live trading requires careful preparation, with paper trading and proper risk management playing crucial roles. By mastering these basics, traders can unlock the full potential of their trading strategies.

Frequently Asked Questions

What is the best way to backtest a trading strategy?

The best way to backtest a trading strategy is to use several weeks of historical data for short-term strategies and several years for long-term strategies, ensuring you have comprehensive market insights to evaluate your approach effectively. This method will provide a solid foundation for your trading decisions.

What is backtesting in trading?

Backtesting is an essential method for assessing a trading strategy by applying it to historical data, enabling traders to evaluate its effectiveness before implementing it in real markets. This process helps in making informed trading decisions based on past performance.

Why is historical market data important for backtesting?

Quality historical market data is essential for accurate backtesting, as it ensures that your analysis reflects true market conditions and avoids misleading outcomes. Using reliable data improves the validity of your trading strategies.

What are the key metrics for evaluating backtested strategies?

The key metrics for evaluating backtested strategies are profit and loss (P&L), risk-adjusted returns (Sharpe ratio), win rate, cumulative returns, and annualized returns. These metrics provide a comprehensive view of strategy performance and risk.

How can I avoid overfitting in backtesting?

To effectively avoid overfitting in backtesting, validate your strategy using a separate testing set and limit excessive optimization. This approach ensures that your strategy is robust and applicable to unseen data.

Comments: 0