Avinger Forecast: 2025-2030 Price Predictions and Analysts

Avinger Inc. (NASDAQ: AVGR) is a medical device company that develops treatments for peripheral artery disease (PAD). As a small cap medical tech company Avinger has caught the attention of investors and analysts. This article is Avinger forecast, Avinger stock price predictions and Avinger’s path from 2025 to 2030.

Table of Contents

About Avinger

Avinger, Inc. is a commercial-stage medical device company that designs, manufactures, and sells image-guided, catheter-based systems for the treatment of peripheral artery disease (PAD). Founded by John B. Simpson and Himanshu N. Patel on March 8, 2007, and headquartered in Redwood City, CA, Avinger has developed a range of innovative products. These include Pantheris, Lightbox, Ocelot, Wildcat, Juicebox, and Kittycat. With a market capitalization of up to $300 million, Avinger is classified as a small-cap company, making it a notable player in the medical tech space. The company’s focus on cutting-edge technology and its commitment to improving patient outcomes have garnered significant attention from investors and analysts alike.

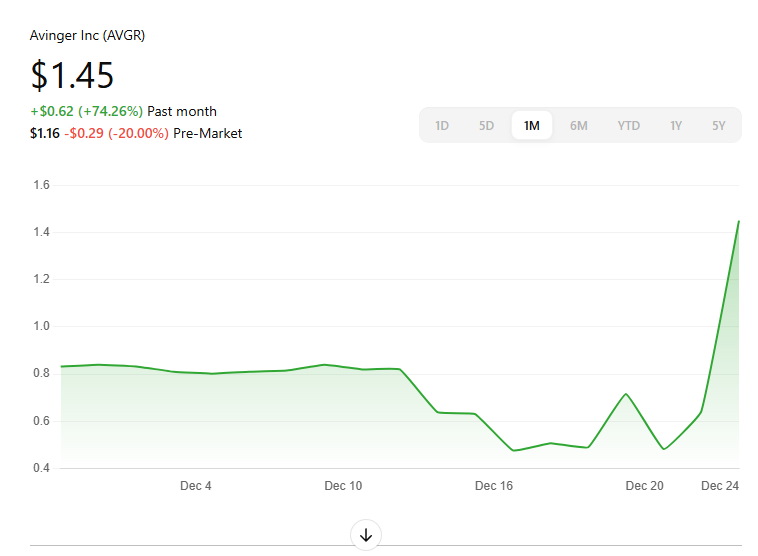

Avinger Stock Price

As of 12/26/2024 Avinger’s stock (AVGR) is trading at $1.45. Over the past year the stock has been up and down for company specific reasons and market reasons.

Analysts Price Targets and Forecasts

Short-Term (2025)

Analysts have different short-term price targets for Avinger stocks:

- MarketBeat: Has an average one year price target of $1.55 which is 6.9% above the current price.

- StockAnalysis: One analyst has a 12 month price target of $5.00 which is over 240% above.

Long-Term (2030)

Long term forecasts for Avinger are more speculative since they are over longer periods:

- StockScan.io: Has Avinger’s stock reaching $118.64 by 2030 which is a big jump from current price.

- CoinCodex: Has a more conservative estimate of $0.50 by Jan 2025.

AVGR Earnings and Sales Forecast

Looking ahead to 2026, Avinger’s earnings forecast presents a mixed picture. The company is expected to report earnings of -$2,749,240, with no variation in the forecasted figures. Revenue growth is projected at 13.43%, indicating a positive trend in sales. However, the net income is anticipated to be -$3.71 million, reflecting a net income growth of -26.23%. This suggests that while sales are increasing, the company is still facing challenges in achieving profitability. The earnings per share (EPS) is forecasted at -$1.82, with an EPS growth rate of -37.61%. Avinger’s price-to-earnings (P/E) ratio stands at 1.44, although the P/E growth has decreased by 7.51%. These figures highlight the financial hurdles Avinger needs to overcome, but also point to potential growth opportunities for the company.

Factors Affecting Avinger’s Stock

- Product Development and Approvals: Success in developing and getting approvals for new devices will drive growth.

- Market Adoption: How fast healthcare providers will adopt Avinger’s technology will impact revenue.

- Financials: Being profitable and having a healthy balance sheet is key to investor confidence.

- Competition: Competition in the medical device space will impact market share and pricing power.

- Regulatory: Changes in healthcare regulations will impact operations.

Technical Analysis and Trading Expectations

Avinger stock currently holds buy signals from both short and long-term Moving Averages, indicating a positive trend. However, there is a general sell signal from the relationship between these two signals, suggesting some caution. A buy signal was issued from a pivot bottom point on Monday, December 16, 2024, and since then, the stock has risen by an impressive 203.98%. This upward momentum is expected to continue until a new top pivot is identified. The rising volume along with the price is a positive sign, although there is a sell signal from the 3-month Moving Average Convergence Divergence (MACD). Investors should keep an eye on these technical indicators to make informed trading decisions.

Technical Indicators for AVGR Stock Forecast

For the upcoming trading day, Avinger stock is expected to open at $1.46 on Thursday, 26th, with a potential trading range between $1.24 and $1.66. This suggests a possible trading interval of +/- $0.211, or +/-14.52% from the last closing price. The estimated move between the lowest and highest trading price during the day is around 29.05%. There is no resistance above, and support is found from accumulated volume at $1.29. Given the several positive signals, Avinger stock should be considered a hold candidate, with potential for accumulation as further developments unfold. The analysis has been upgraded from a Sell to a Hold/Accumulate candidate, reflecting the system’s expectation of high volatility and risk for the following trading day. Investors should be prepared for the stock to move in either direction, making it crucial to stay informed and ready to act based on market conditions.

AVGR Forecast FAQ

Q: What is the current price target? A: $1.55 (average one year price target), $5.00 (one analyst)

Q: Is Avinger a good investment? A: Investment depends on your risk tolerance and investment goals. Since small cap medical device companies are speculative, do your own due diligence.

Q: What are the risks? A: Product development, regulatory, competition, financials.

Q: How does Avinger’s market cap compare to its peers? A: Avinger’s market cap is small compared to bigger medical device companies, it’s a small cap medical tech company.

Q: Where can I find analyst ratings for Avinger? A: MarketBeat and StockAnalysis.

Q: What is included in the AVGR stock forecast FAQ? A: The AVGR stock forecast FAQ includes a series of questions and answers regarding the stock performance and analyst opinions on AVGR, focusing on aspects such as average price targets, potential upside, and how to track stock ratings from top analysts.

Bottom Line

Avinger Inc is a high reward investment in the medical device space. But the 2025 to 2030 forecast varies big time among analysts so do your own due diligence, stay informed through financial news and consult with financial advisors.

Do your own due diligence. Firebase. 🙂atchet. 🙂 (Financial advice) 😉 (Invest at your own risk)

Comments: 0