Bit Digital Forecast 2025-2030: Price Predictions

Bit Digital Inc (BTBT) has become a hot topic in the crypto mining space and investors and analysts are taking notice. As we head into 2025 it’s important to understand the bit digital forecast and what it means for the market. Here we’ll get into the analysts average price target, including the 12-month average price target of $6.13 for Bit Digital, key market trends and expert predictions to help you make a smarter investment.

Table of Contents

Bit Digital

The bit digital forecast for 2025 covers a range of possibilities, with analysts weighing in based on the company’s financials, industry trends and market cap. The bit digital inc stock performance is analyzed through various indicators such as support levels, volatility, and trading trends.

Key Metrics and Average Price Target

- Current Price: $10.25 by 2025

- Last Close: Nasdaq close

- Analysts’ Average Target: 12 month target

- Stock Ratings: Detailed insights into the analyst ratings for Bit Digital, including the consensus rating, average price targets, and potential upside. These ratings assist investors in making informed decisions and encourage following top analysts for comprehensive insights into stock performance.

Bull and Bear Forecasts

- BTBT Upside: Bullish analysts say buy, with a target increase of up to $10.25.

- Bear Forecast: Bearish predictions warn of potential downside risks due to market and regulatory volatility. A negative forecast indicates a pessimistic outlook, driven by various sell signals generated from moving averages and trading patterns. The divergence between volume and price serves as a warning sign, emphasizing the need to monitor the stock closely for potential further declines.

Bit Digital Insights

Bit Digital’s approach to cryptocurrency mining sets it apart in the competitive space. The company is focused on sustainable energy and global expansion making the stock attractive to eco-friendly investors.

Current Market Overview

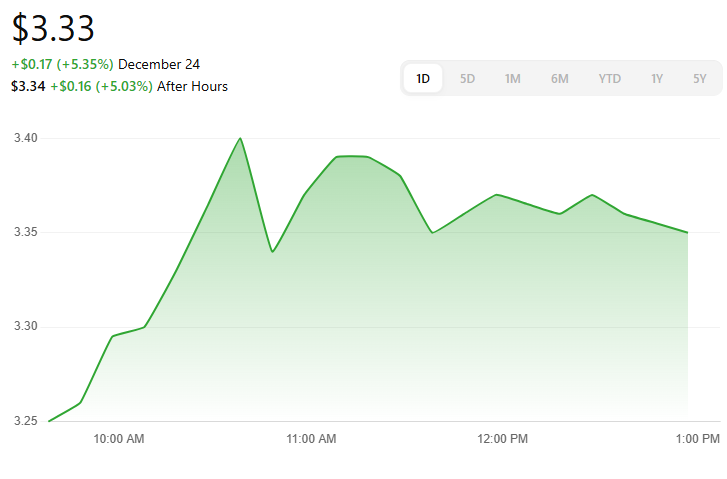

As of December 24, 2024, Bit Digital’s stock (BTBT) is trading at $3.33. Analysts project BTBT’s upside potential at 84.08% compared to the current stock price, with a 12-month average price target of $6.33.

Analyst Price Targets

The analyst price targets for Bit Digital (BTBT) stock are based on the consensus of Wall Street analysts. The average price target for BTBT is $6.13, which represents an upside potential of 84.08% from the current price of $3.18. This optimistic outlook is supported by a range of price targets, with the highest being $7.00 and the lowest at $5.50. The consensus rating for BTBT is a Strong Buy, reflecting the positive sentiment among analysts. This average price target represents a significant opportunity for investors looking to capitalize on BTBT’s upside potential.

Earnings and Sales Forecast

The earnings forecast for Bit Digital (BTBT) stock is derived from the consensus of Wall Street analysts. For the next quarter, the earnings estimate is -$0.03, with a range spanning from -$0.07 to $0.04. This follows a previous quarter’s EPS of -$0.26, where the beat rate was 50.00%, compared to the industry beat rate of 62.66%. On the sales front, BTBT is projected to achieve $28.27M, with estimates ranging from $21.50M to $40.51M. The previous quarter’s sales were $22.71M, with a beat rate of 75.00%, surpassing the industry beat rate of 81.31%. These forecasts indicate a robust growth trajectory for Bit Digital, making it a compelling consideration for investors.

Price Predictions for 2025, 2027, and 2030

2025 Forecast

Analysts project that BTBT could reach an average price of $10.25 by 2025, with estimates ranging from a low of $1.64 to a high of $18.87. This suggests a potential increase of over 200% from the current price.

2027 Forecast

While specific forecasts for 2027 are limited, some projections estimate BTBT’s price to be around $1.85, indicating a potential decrease from current levels.

2030 Forecast

Long-term projections suggest that BTBT could reach approximately $6.49 by 2030, representing a potential increase of about 95% from the current price.

Bit Digital Price Predictions

Disclaimer: This table is based on analyst predictions and should not be considered financial advice.

| Analyst | Price Target | Upside Potential | Broker Rating |

|---|---|---|---|

| Kevin Dede (HC Wainwright & Co.) | $7.00 | 110.2% | Buy |

| Mark Palmer (BTIG Research) | $6.00 | 80.2% | Buy |

| Michael Latimore (Northland Capital Markets) | $5.50 | 65.2% | Buy |

| Dawei Dai (B. Riley Securities) | $4.85 | 45.4% | Buy |

| Average | $5.84 | 74.3% | Strong Buy |

Key Points:

- Strong Buy Consensus: All analysts surveyed have a “Buy” rating on Bit Digital, indicating strong bullish sentiment.

- Significant Upside Potential: The average price target of $5.84 represents a 74.3% upside from the last closing price of $3.35.

- Wide Range of Forecasts: The price targets range from a low of $4.85 to a high of $7.00, reflecting the uncertainty surrounding the cryptocurrency market.

Factors Influencing Price Predictions

- Cryptocurrency Market Trends: BTBT’s performance is closely tied to the volatility and overall health of the cryptocurrency market.

- Regulatory Environment: Changes in regulations affecting cryptocurrency mining can significantly impact BTBT’s operations and profitability.

- Technological Advancements: Adoption of more efficient mining technologies could enhance BTBT’s competitiveness and market position.

Trading Expectations and Strategies

The trading expectations for Bit Digital (BTBT) stock are informed by technical indicators and prevailing market trends. The stock is anticipated to fluctuate between $2.89 and $3.77 during the day, with a potential trading interval of +/-$0.437 (+/-13.13%) from the last closing price. Despite being considered a Strong Sell Candidate in the short term, due to market volatility, BTBT presents a promising buy opportunity for long-term investors. The stock’s strong growth potential and favorable analyst ratings suggest that those willing to hold BTBT stock could benefit significantly as the company continues to expand and innovate in the cryptocurrency mining sector.

Buy or Sell BTBT?

The decision to buy Bit Digital stock is based on:

- Market Sentiment: Analysts are split between buy and hold.

- Company Fundamentals: Strong fundamentals and strategy means growth potential.

- Market Conditions: Crypto volatility makes BTBT a speculative stock.

Expert Views

- Bullish: Some think big growth due to Bit Digital’s mining tech.

- Bearish: Critics say the company is exposed to crypto price volatility and increased competition.

FAQs

What’s the future of BTBT stock?

The future of BTBT stock depends on the company’s ability to adjust to the market and its operational leverage.

Buy or Sell?

Most analysts are speculative buy if the market trends and company performs.

What’s the stock price prediction for BTBT 2025?

2025 predictions range from moderate growth to 2x current price.

Is BTBT cheap?

Some think BTBT is cheap compared to its peers due to growth and operational leverage.

Summary

The bit digital forecast 2025 is mixed, with big upside and risks. Use the analysts’ average target, company fundamentals and market conditions to make a informed decision. Buy BTBT or wait? Either way, know the market.

Comments: 0