How to Trade A Morning Star Candlestick Pattern?

The Morning Star pattern is a widely recognized bullish reversal pattern that signals a potential change in market direction from bearish to bullish. It is commonly observed in financial markets, including forex, stocks, and commodities. Traders use this pattern to identify opportunities to enter long positions after a downtrend. Here’s a detailed breakdown of the Morning Star candlestick, how to spot it, and how to trade it effectively.

Table of Contents

What is the Morning Star Candlestick Pattern?

The Morning Star candlestick pattern is a three-candle formation that typically appears at the bottom of a downtrend. It represents a transition in market sentiment, where selling pressure diminishes and buyers begin to regain control, pushing prices higher.

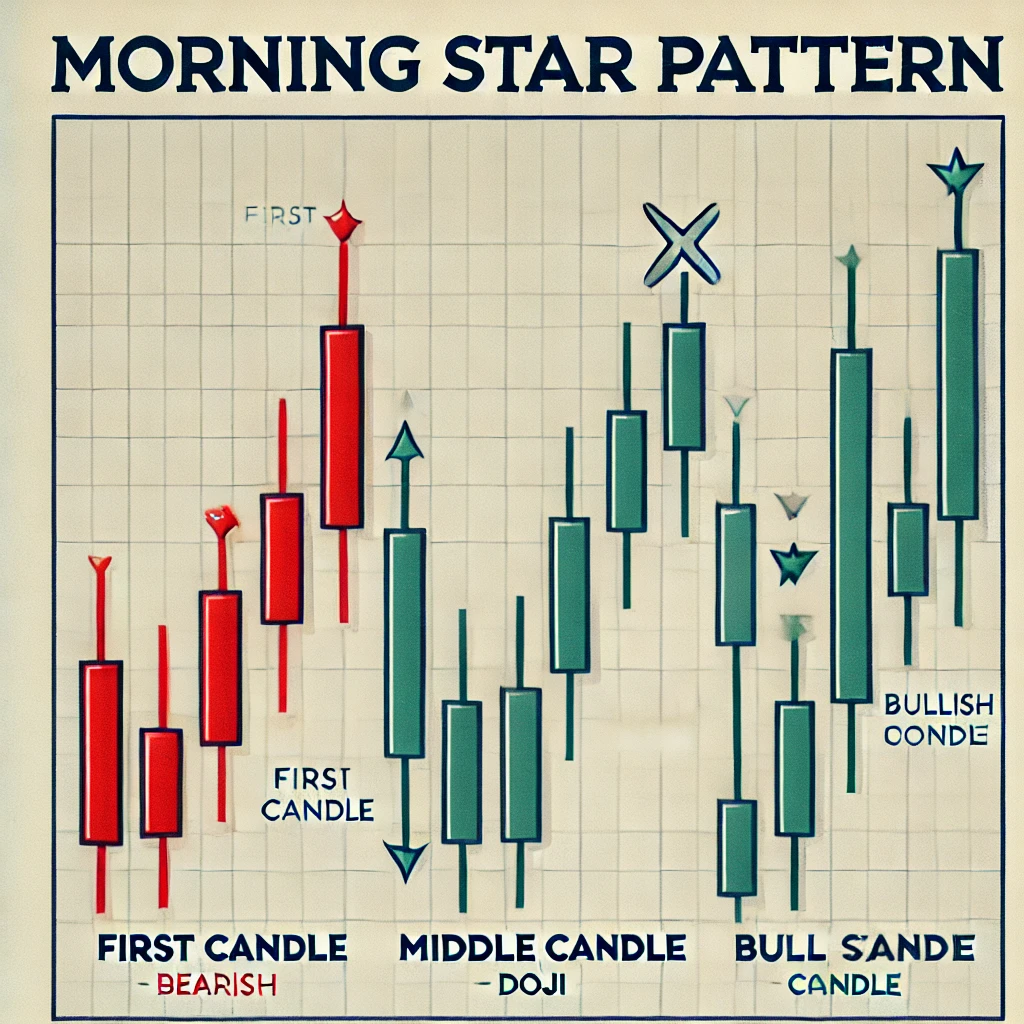

Structure of the Morning Star Pattern

The Morning Star consists of three distinct candlesticks:

1. First Candle (Bearish Candle)

- The first candle is a long bearish candle, reflecting strong selling pressure.

- It shows that the bears are firmly in control of the market at this point.

2. Second Candle (Middle Candle)

- The second, or middle, candle is small-bodied and can be a bullish, bearish, or neutral candle, often resembling a doji or spinning top.

- It reflects market indecision as both buyers and sellers hesitate to take control. This pause indicates a potential reversal point.

3. Third Candle (Bullish Candle)

- The third candle is a long bullish candle that closes well above the midpoint of the first bearish candle.

- This candle signifies that buyers have regained strength, marking the start of an upward trend.

Key Characteristics of the Morning Star Pattern

- Trend Reversal: The pattern usually forms at the bottom of a downtrend.

- Volume Confirmation: Increasing volume during the bullish candle (third candle) adds credibility to the pattern.

- Gap Formation: In markets like stocks, the second candle may form a gap below the first and third candles, but this is less common in forex due to 24-hour trading.

- Strength of the Third Candle: The third candle should close significantly above the midpoint of the first candle to confirm the reversal.

Morning Star vs. Evening Star Patterns

While the Morning Star pattern signals a bullish reversal at the bottom of a downtrend, the Evening Star pattern is the opposite. The Evening Star appears at the top of an uptrend and signals a bearish reversal. It consists of a long bullish candle, a small middle candle, and a strong bearish candle. Traders use both patterns to identify potential turning points in the market.

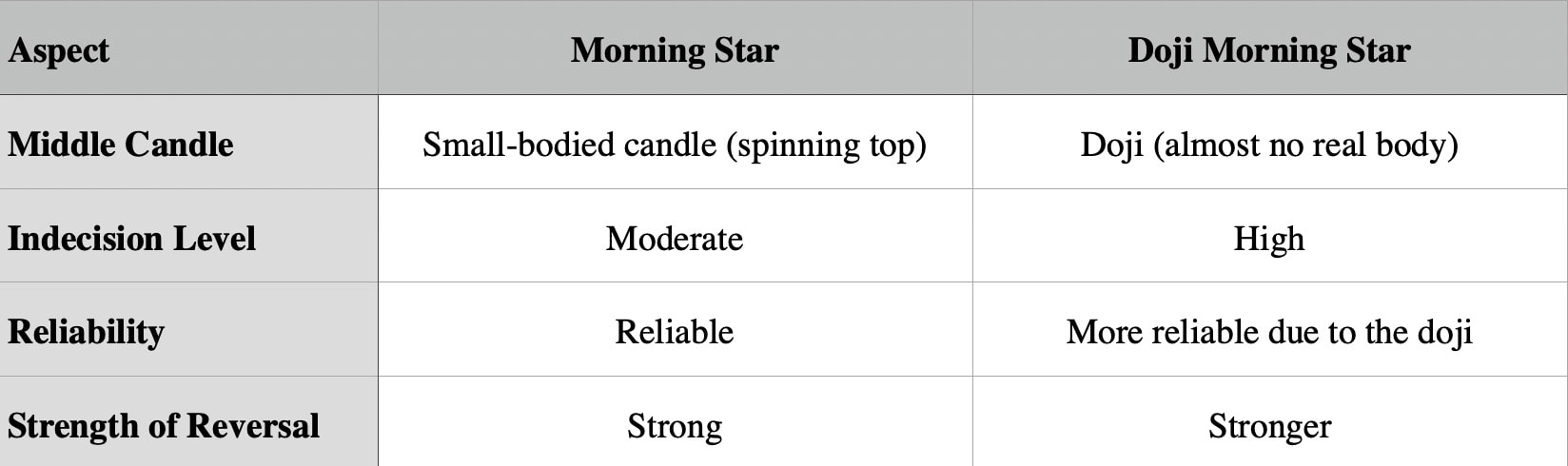

Morning Star vs. Doji Morning Star Patterns

The Morning Star candlestick pattern and the Doji Morning Star are both bullish reversal patterns that indicate a potential shift in market sentiment from bearish to bullish. While they share a similar structure, the key difference lies in the characteristics of the middle candle.

Key Difference between Morning Star pattern and Doji Morning Star pattern

How to Identify a Morning Star Candlestick Pattern

Spotting a Morning Star candlestick pattern requires a combination of pattern recognition and confirmation with other tools.

1. Look for a Downtrend

- The Morning Star forms after a sustained period of declining prices.

2. Examine the Three Candles

- First Candle: A strong bearish candle showing heavy selling pressure.

- Middle Candle: A smaller-bodied candle indicating indecision.

- Bullish Candle: A strong bullish candle that closes above the midpoint of the first candle.

3. Use Technical Indicators

- Confirm the reversal with tools like RSI (to check for oversold conditions) or MACD (for bullish crossovers).

4. Check Volume

- Higher trading volume on the third candle reinforces the validity of the pattern.

How to Trade the Morning Star Pattern

Once you’ve identified a valid Morning Star pattern, you can use it to enter a long position. Here’s a step-by-step guide:

Step 1: Confirm the Pattern

- Wait for the third candle to close to ensure the pattern is complete.

- Double-check that the bullish candle closes well above the midpoint of the first bearish candle.

Step 2: Choose Your Entry Point

- Conservative Approach: Enter the trade when the price moves above the high of the third candle.

- Aggressive Approach: Enter immediately at the close of the third candle to take advantage of early momentum.

Step 3: Set Stop-Loss

- Place a stop-loss below the low of the second candle (the lowest point of the pattern). This protects you if the reversal fails.

Step 4: Define Your Profit Target

- Use nearby resistance levels or Fibonacci retracement levels to set a realistic profit target.

- Alternatively, aim for a risk-reward ratio of 1:2 or 1:3.

Step 5: Monitor the Trade

- Look for confirmation of the bullish trend, such as higher highs and higher lows forming after the pattern.

- Adjust your stop-loss to breakeven or use a trailing stop to secure profits as the price moves in your favor.

Example of Trading a Morning Star Pattern

Imagine the EUR/USD pair has been in a steady downtrend. You notice the following:

- The first candle is a strong bearish candle closing near its lows.

- The middle candle is a small doji, indicating market indecision.

- The bullish candle closes above the midpoint of the first candle.

You confirm the pattern using RSI, which shows the pair is oversold. You enter a long position above the high of the third candle, set your stop-loss below the second candle’s low, and aim for the next resistance level as your profit target.

Tips for Trading the Morning Star Pattern

1. Combine with Other Indicators

Use tools like trendlines, support, and resistance levels, or oscillators to confirm the pattern’s reliability.

2. Be Patient

Wait for the third candle to close before entering a trade to avoid false signals.

3. Risk Management is Key

Always set a stop-loss and never risk more than you’re willing to lose.

4. Practice in a Demo Account

If you’re new to trading, practice spotting and trading the pattern in a demo account before using real money.

The Pros and Cons of the Morning Star Candlestick Pattern

The Morning Star pattern is a reliable tool in technical analysis, however, like any trading strategy, it has its strengths and weaknesses. Let’s break down the pros and cons of the Morning Star formation in a way that’s easy to understand.

Pros of the Morning Star Pattern

1. Clear Bullish Reversal Pattern

The Morning Star pattern is easy to recognize and provides a clear indication of a potential reversal from bearish to bullish sentiment.

- Why It’s Helpful: The three-candle structure helps confirm the market’s transition from sellers to buyers.

2. Works Well with Other Indicators

This pattern becomes even more reliable when paired with other technical tools like RSI, MACD, or support and resistance levels.

- Example: If the Morning Star formation appears near a support level and the RSI shows oversold conditions, it strengthens the signal.

3. Provides a Logical Entry Point

The third candle in the pattern, a strong bullish candle, offers a clear point to enter the trade.

- Why It’s Important: It reduces guesswork and makes it easier to time your trades.

4. Suitable for Multiple Markets

The Morning Star pattern works across various asset classes like stocks, forex, and commodities, making it versatile.

5. Easy to Understand

The Morning Star candlestick pattern is visually simple, making it a good choice for both beginner and experienced traders.

Cons of the Morning Star Pattern

1. Requires Confirmation

The pattern isn’t reliable on its own and often requires confirmation through volume, trendlines, or other indicators.

- Why This Matters: Without confirmation, there’s a higher risk of false signals, especially in choppy markets.

2. Limited in Strong Trends

The Morning Star formation works best in a clearly defined downtrend.

- Drawback: In sideways or strongly bearish markets, the pattern may fail to indicate a true reversal.

3. Can Be Misleading in Low Liquidity Markets

In markets with low trading volume, like certain penny stocks or exotic forex pairs, the Morning Star pattern may not form reliably.

- Why It’s a Problem: Low liquidity can lead to irregular price movements, making the pattern less dependable.

4. Timing Can Be Tricky

Waiting for the third candle to close for confirmation can sometimes result in entering the trade later, reducing potential profits.

- Example: By the time the bullish candle closes, a significant portion of the move may already have happened.

5. Doesn’t Guarantee Success

Like all patterns, the Morning Star pattern is not foolproof. Market conditions, news events, and other factors can override the signal.

- Takeaway: It’s a tool, not a guarantee, so risk management is essential.

When to Use the Morning Star Pattern

Best Situations:

- In well-established downtrends where a reversal is likely.

- When supported by other technical indicators or market fundamentals.

When to Be Cautious:

- During highly volatile periods, like after major news releases, where patterns can form but quickly reverse.

- In low-volume markets, where the Morning Star pattern might be unreliable.

What Technical Indicator is Best to Trade with the Morning Star Pattern?

For the best results, use multiple indicators together to confirm the pattern.

1. Relative Strength Index (RSI)

Why It Works:

- RSI measures the strength of price movements and identifies overbought or oversold conditions.

- If the RSI is below 30 (oversold) and the Morning Star pattern forms, it adds weight to the bullish reversal signal.

How to Use It:

- Look for the RSI to move upward after the pattern forms, signaling strengthening bullish momentum.

- A bullish divergence (when the price makes lower lows, but the RSI makes higher lows) can further confirm the reversal.

2. Moving Averages (MA)

Why It Works:

- Moving averages help identify overall market trends and key levels of support or resistance.

- The Morning Star formation is more reliable if it appears near a major moving average, such as the 50-day or 200-day MA.

How to Use It:

- Dynamic Support: If the Morning Star forms around the moving average acting as support, it reinforces the bullish signal.

- Use the moving average crossover strategy to confirm the trend shift (e.g., the 10-day MA crossing above the 50-day MA).

3. Bollinger Bands

Why It Works:

- Bollinger Bands measure price volatility and can indicate when a price is oversold or overbought.

- The Morning Star candlestick pattern forming near the lower Bollinger Band often signals a potential reversal.

How to Use It:

- Look for the pattern to form at or slightly outside the lower band, suggesting the price is oversold and ready to reverse.

- Combine this with a contraction in the bands to anticipate a breakout.

4. Fibonacci Retracement Levels

Why It Works:

- Fibonacci retracement levels identify potential support or resistance levels during a trend reversal.

- A Morning Star pattern forming near a key Fibonacci level (e.g., 61.8%) provides a strong reversal confirmation.

How to Use It:

- Draw Fibonacci levels from the previous swing high to the swing low in the downtrend.

- If the pattern aligns with a Fibonacci level, it increases the likelihood of a successful trade.

5. Volume Indicators (e.g., OBV, Volume Oscillator)

Why It Works:

- Volume confirms the strength of the reversal. A significant increase in volume during the third (bullish) candle indicates strong buyer interest.

How to Use It:

- Monitor volume levels throughout the Morning Star formation.

- A volume spike on the bullish candle strengthens the pattern’s reliability.

6. MACD (Moving Average Convergence Divergence)

Why It Works:

- MACD identifies momentum and trend reversals, making it a great tool to confirm the bullish reversal of the Morning Star.

- A bullish crossover (when the MACD line crosses above the signal line) supports the pattern.

How to Use It:

- Look for a MACD crossover after the Morning Star forms.

- Positive MACD histogram bars can signal growing bullish momentum.

7. Stochastic Oscillator

Why It Works:

- Like RSI, the Stochastic Oscillator identifies overbought or oversold conditions but focuses on the closing price relative to its price range.

- A Morning Star pattern forming when the Stochastic is below 20 (oversold) adds confirmation to the reversal.

How to Use It:

- Look for the Stochastic Oscillator to cross upwards from the oversold zone after the pattern forms.

FAQs

Is a Morning Star Pattern Bullish or Bearish?

The Morning Star pattern is a bullish reversal pattern that signals a possible shift from a downtrend to an uptrend. It shows that the bearish momentum is losing strength and buyers are starting to take control, pointing to an upward movement in price.

Is a Doji Morning Star Pattern Bullish or Bearish?

The Doji Morning Star pattern is also a bullish reversal pattern, but it adds an extra layer of significance. The doji, which appears as the second candle in this variation, represents a moment of indecision in the market. This pause highlights a more pronounced shift from bearish to bullish sentiment, making the reversal signal stronger and more reliable.

What Is the Success Rate of the Morning Star Pattern?

The success rate of the Morning Star pattern can vary depending on factors like market conditions, the type of asset being traded, and how well the pattern is confirmed by other tools. On its own, the Morning Star is moderately reliable, with a success rate of around 60% to 70% when used in the right context and supported by additional analysis.

Final Words

The Morning Star pattern is a popular bullish reversal signal that traders use to identify potential upward trends after a downtrend. But remember, it’s not foolproof. Always confirm it with other technical indicators and tools, and approach trading with a clear plan and proper risk management.

Comments: 0