Maximize Returns with the FTSE 100 Index Yield: A Comprehensive Guide

The FTSE 100 Index is one of the most recognized stock market indices in the UK, tracking the top 100 largest publicly traded companies on the London Stock Exchange (LSE). For investors looking to generate income, FTSE 100 index yield plays a crucial role in determining the potential returns from dividends.

Table of Contents

This guide explores the FTSE 100 Index yield, its historical performance, and how investors can maximize their returns while considering factors like income tax and market trends.

Understanding the FTSE 100 Index

The FTSE 100 Index, often referred to as the “Footsie,” is a cornerstone of the UK stock market. It comprises the 100 largest companies listed on the London Stock Exchange (LSE) by market capitalization. This index serves as a barometer for the overall health and performance of the UK’s largest companies, making it a crucial reference point for investors. The FTSE 100 is calculated in real-time, with updates occurring continuously throughout the trading day, reflecting the dynamic nature of the market. As a market-capitalization-weighted index, the companies with the largest market caps exert the most significant influence on the index’s performance, ensuring that the index accurately represents the market’s movements.

What is the FTSE 100 Index Yield?

The FTSE 100 index yield refers to the average dividend yield of all the 100 companies listed in the index. It measures the percentage of dividends paid out relative to the index’s overall market price. FTSE 100 companies must not only offer a dividend but also ensure they pay dividends at a certain yield threshold, emphasizing the importance of consistent dividend payments in investment decisions.

How is the FTSE 100 Yield Calculated?

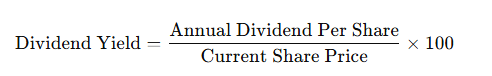

- Dividend Yield Formula:

- The FTSE 100 index yield is the weighted average of the dividend yields of all 100 companies in the index.

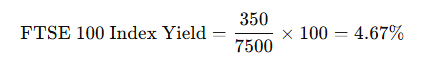

Example: If the FTSE 100 index level is 7,500 and the total dividends paid by all companies in a year amount to 350 points, then:

This means that, on average, investors can expect a 4.67% return from dividends if they invest in FTSE 100 stocks. While past performance is a useful indicator, it should not be solely relied upon to predict future returns.

Benefits of Investing in the FTSE 100 Index

Investing in the FTSE 100 Index offers several compelling benefits. One of the primary advantages is diversification. By tracking the performance of 100 different companies across various sectors, the FTSE 100 Index helps to spread risk, reducing the impact of poor performance in any single company or sector. This diversification can lead to more stable returns over time. Additionally, the FTSE 100 Index is a well-established and widely followed benchmark, providing investors with a reliable way to gain exposure to the UK stock market. Another significant benefit is the potential for regular income through dividends. Many companies in the FTSE 100 are known for their consistent dividend payouts, making the index an attractive option for income-seeking investors.

FTSE 100 Index Yield vs. Other Investments

| Investment Type | Average Yield (%) | Risk Level | Income Tax Consideration |

|---|---|---|---|

| FTSE 100 Index | 3.5% – 4.5% | Moderate | Dividend Tax Applicable |

| FTSE 100 ETFs | 3.0% – 4.0% | Moderate | ETF Income Tax Applies |

| Government Bonds | 1.5% – 2.5% | Low | Capital Gains Tax (CGT) |

| Corporate Bonds | 2.0% – 3.5% | Low to Moderate | CGT & Interest Tax |

| Savings Accounts | 1.0% – 2.0% | Low | Tax-Free up to Allowance |

| Property Rental | 3.0% – 6.0% | High | Rental Income Tax Applies |

The FTSE 100 Index Yield offers a competitive return compared to other income-generating investments, making it attractive for long-term investors seeking dividends. However, individuals should be aware that they may not recover the full amount invested due to fluctuating market conditions.

Historical Performance of FTSE 100 Dividend Yield

| Year | FTSE 100 Index Yield (%) | FTSE 100 Closing Level |

|---|---|---|

| 2020 | 4.1% | 6,460 |

| 2021 | 3.9% | 7,140 |

| 2022 | 4.2% | 7,451 |

| 2023 | 3.7% | 7,730 |

| 2024 | 3.8% | 7,880 |

While historical data is useful, it is crucial to verify the accuracy of any data provided before making investment decisions. We accept no responsibility for any inaccuracies and advise users to independently verify information.

Key Observations

- The FTSE 100 yield has remained stable between 3.5% and 4.5%, even during economic downturns. The information presented does not constitute a personal recommendation for any particular investment.

- The index level has grown steadily, offering investors capital appreciation alongside dividends.

- Dividend sustainability depends on corporate earnings, economic conditions, and sector performance.

Which FTSE 100 Companies Have the Highest Yields?

Below are some of the top dividend-paying stocks in the FTSE 100 Index:

| Company | Sector | Dividend Yield (%) |

|---|---|---|

| British American Tobacco | Consumer Goods | 7.5% |

| Rio Tinto | Mining | 6.8% |

| Legal & General | Financials | 7.2% |

| Imperial Brands | Consumer Goods | 7.3% |

| M&G | Financials | 8.1% |

| Vodafone | Telecom | 6.4% |

These stocks are known for high dividend payouts but may come with sector-specific risks.

How to Invest in FTSE 100 for Dividend Income

1. Buy Individual Dividend Stocks

- Investing in companies with a consistent dividend history ensures regular income.

- Focus on blue-chip stocks with sustainable earnings.

2. Invest in FTSE 100 ETFs

- Exchange-Traded Funds (ETFs) offer diversification and lower risk.

- Popular FTSE 100 ETFs:

- Vanguard FTSE 100 ETF (VUKE)

- iShares Core FTSE 100 ETF

- HSBC FTSE 100 UCITS ETF

3. Consider Dividend Growth Funds

- Funds that reinvest dividends allow for compounded returns.

- Example: FTSE 100 High Dividend Yield Index Fund

4. Use Dividend Reinvestment Plans (DRIPs)

- Automatically reinvest dividends to buy more shares.

- Maximizes long-term growth and compounding returns.

Getting Started

To start investing in the FTSE 100 Index, the first step is to open an account with a reputable online broker or investment platform. This account will give you access to various investment products, including index funds and exchange-traded funds (ETFs) that track the FTSE 100 Index. Once your account is set up, you can deposit funds and use them to purchase units in your chosen investment product. It’s crucial to conduct thorough research and consider your financial goals and risk tolerance before making any investment decisions. Understanding the specific features and fees associated with different investment products can help you make informed choices that align with your long-term objectives.

Risk Management

Investing in the FTSE 100 Index, like any investment, comes with its share of risks. Market volatility is a significant concern, as the value of the index can fluctuate rapidly in response to economic and political events. Additionally, investing in the FTSE 100 Index means exposure to the performance of the UK stock market, which can be influenced by factors such as interest rates, inflation, and global economic trends. To manage these risks, consider diversifying your portfolio by including other asset classes, such as bonds or international equities. Maintaining a long-term perspective is also essential, as it helps to avoid impulsive decisions based on short-term market movements. By staying informed and adopting a strategic approach, you can navigate the risks and maximize the potential returns from your investments in the FTSE 100 Index.

Tax Considerations on FTSE 100 Dividends

Investors must be aware of tax obligations on dividends:

| Investor Type | Dividend Tax Rate |

|---|---|

| Basic Rate Taxpayer (Up to £50,270 income) | 8.75% |

| Higher Rate Taxpayer (£50,271 – £125,140) | 33.75% |

| Additional Rate Taxpayer (Above £125,140) | 39.35% |

- Dividend Allowance: The first £1,000 of dividend income is tax-free.

- **ISAs & SIPPs:**Investing in a Stocks & Shares ISA shelters dividends from taxation.

Higher rate taxpayers face increased capital gains tax rates, which significantly impacts their dividend income compared to basic rate taxpayers.

Future Outlook for FTSE 100 Dividend Yield

- Dividend Growth Prospects: Companies are expected to increase payouts due to profit recovery post-COVID. However, past performance should not be solely relied upon to predict future returns.

- Economic & Inflation Impact: Rising inflation could affect corporate profitability, influencing dividend yields.

- **Sector Performance:**Mining, energy, and consumer goods stocks are projected to lead dividend growth.

Final Thoughts

The FTSE 100 Index Yield provides a stable source of income for investors seeking dividends. Whether investing in individual stocks, ETFs, or dividend funds, understanding historical trends, tax implications, and market conditions is key to maximizing returns.

If you’re looking to boost your investment income, FTSE 100 dividend stocks could be a strategic addition to your portfolio.

Start investing today and build a strong dividend portfolio for the future

Comments: 0